Does Paypal Pay Dividends?

As an investor, one of the first things you may want to check about a company is whether or not they offer dividends – these payouts represent part of their profits that is distributed back out as dividends to their shareholders. Online payment platforms such as Paypal can be an excellent way to generate passive income and build wealth over time, but are they paying dividends? In this article we’ll take a deeper look into Paypal to determine whether it pays any dividends.

Paypal’s Background

Before discussing PayPal’s dividend policy in detail, let’s briefly review what it is and how it operates. Paypal was established as an online payment system in 1998 to make money transfers easier for individuals and businesses alike. PayPal operates in over 200 markets globally and boasts more than 325 million active user accounts worldwide. Their services span peer-to-peer payments, mobile payments, merchant services for businesses and merchant services for consumers. Users can connect their bank and credit cards to Paypal accounts for easy money transfers between accounts or online shopping purchases.

No Dividends Distributed Since 2020

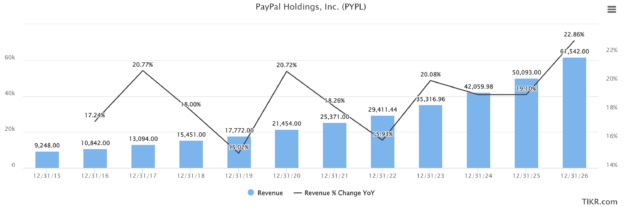

Answer: No dividends have been distributed since 2020 by Paypal to shareholders; instead, profits have been reinvested back into its business operations. Paypal remains in its early days of growth and thus provides ample opportunities for expansion into both existing and new markets. Although some investors might view Paypal’s lack of dividend payments negatively, others may take it as an encouraging sign. Just by investing the profits back into its business, management shows they believe there are plenty of growth opportunities ahead.

Factors Affecting Paypal’s Dividend Policy

While Paypal currently does not pay dividends, that could change in the near future. There are a few factors that could have an effect on Paypal’s dividend policy moving forward:

- Growth Opportunities: As previously noted, Paypal remains in an expansionary mode and has many opportunities available to it for expansion.

- Competition: Paypal faces fierce competition from other online payment platforms like Square and Stripe, who provide similar payment solutions. If Paypal’s competitors begin offering dividends, this could put pressure on Paypal to do the same to remain competitive.

- Shareholder Pressure: Some investors may pressurize Paypal into offering dividends in order to generate income for their portfolios.

Conclusion

Despite Paypal not currently paying dividends, their future dividend policy is far from certain. As with any investment decision, investors should carefully evaluate both risks and rewards before investing in Paypal stock. That being said, if you’re searching for an opportunity for growth with plenty of potential upside, PayPal could be worth taking a closer look at. PayPal stands to continue expanding for years to come with its massive user base, global reach and innovative products and services. Please visit their websites for more information:

–https://www.paypal.com/us/webapps/mpp/about

–http://investopedia.com/terms/d/dividend.asp

–NASDAQ’s market activity section/stocks/pypl/dividend-history