PayPal and Silicon Valley Bank Partnership: What It Means for Businesses and Consumers

As more and more of us embrace digital payments, PayPal and Silicon Valley Bank have emerged as two of the foremost players in this field. PayPal is the go-to service for online payments, while Silicon Valley Bank serves startups and innovative companies. But what happens when these two titans come together? In this article, we’ll take an in-depth look at PayPal and Silicon Valley Bank’s partnership and what it means for businesses and consumers alike.

What Is PayPal? (If You Don’t Already Know)

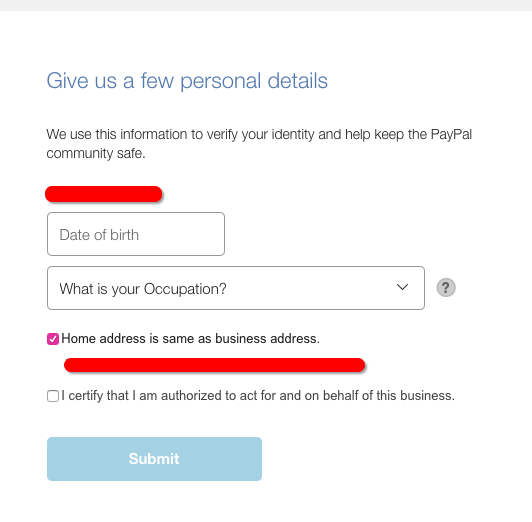

In case you don’t already know what PayPal is all about – here’s an introduction). PayPal is an online payment system that enables individuals and businesses to send and receive money electronically. Since its founding in 1998, PayPal has grown into one of the world’s most widely used payment solutions. One key benefit of using PayPal is its ease of use. Just provide your email address and password, and you can begin sending and receiving money immediately. PayPal also provides buyer protection, giving users peace of mind when purchasing online.

What Is Silicon Valley Bank (SVB)?

SVB is a specialized bank that specializes in offering financial services to startups and innovative companies. Established in 1983, SVB Bank has since become the banker to the tech industry. Offering loans, credit cards and cash management solutions; their main draw is their expertise working with startups. SVB understands the unique challenges startups face, and offers tailored solutions to help them thrive. Wikipedia

PayPal chose Silicon Valley Bank because of their expertise in working with startups. PayPal and SVB’s partnership was announced in 2016 as one that allowed PayPal to extend its services to more businesses, especially startups in the startup space. SVB became PayPal merchant customers’ preferred banking partner as part of this agreement.

What this Partnership Means for Businesses

This partnership offers several advantages for businesses. First and foremost, PayPal-SVB partnership gives startup organizations access to two of the industry’s leading names in digital payments and startup banking – an invaluable asset when getting off the ground. Furthermore, their collaboration helps streamline financial operations. Businesses can leverage both services to streamline payment processing and cash management processes.

What Does This Partnership Mean for Consumers?

Consumers also stand to gain from this partnership; one benefit may be more businesses accepting PayPal as payment form. Consumers who use PayPal for online purchases will welcome this news, and can take comfort in the added security they provide. Consumers can shop online with peace of mind knowing their transactions are protected thanks to PayPal and Silicon Valley Bank’s partnership, making an important step forward for digital payments and startup banking services.

By joining forces, PayPal and Silicon Valley Bank have come together to offer comprehensive services to both businesses and consumers alike. Now is an ideal time for anyone wanting to take advantage of this partnership; whether that means easier payment processing or increased security while shopping online – PayPal and Silicon Valley Bank have you covered. For more information visit either company directly. Referral links for these two firms are below:PayPal and Silicon Valley Bank respectively.